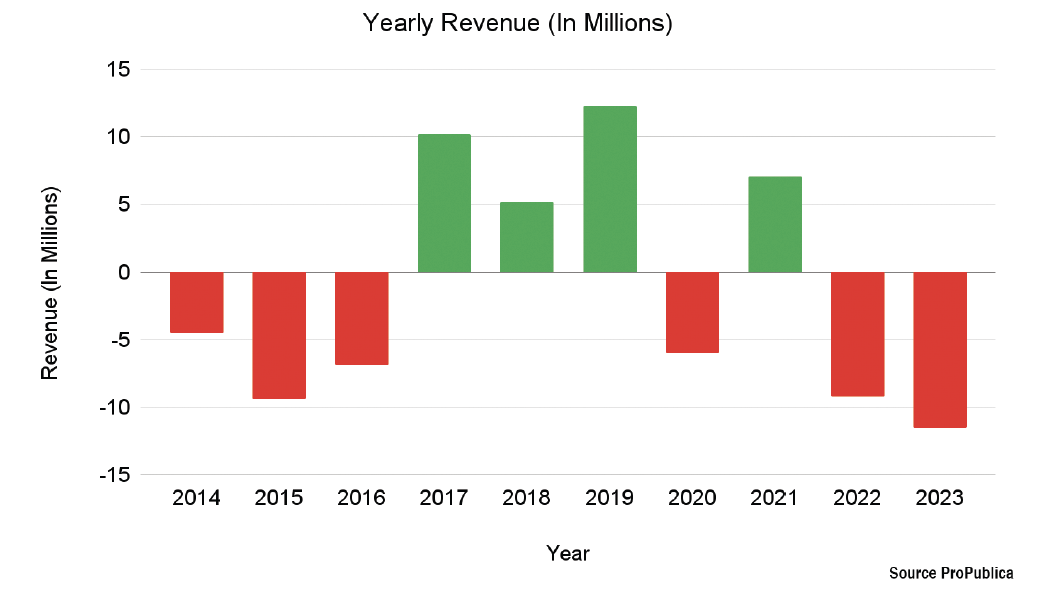

President Kathryn Morris announced that St. Lawrence University will reduce retirement contributions for non-union employees effective Jan. 1, 2024. This change comes as Morris and the university attempt to eliminate an estimated $11.5 million structural deficit for the 2023-24 academic year, an increase from the $9 million deficit the university faced in 2022.

In addition to reducing retirement contributions for non-union employees from 10 percent to 6 percent, the administration, under Morris’s leadership, plans to cut a benefit program that provides employees who retire between the ages of 62 and 65 with health insurance until the retiree turns 65.

Despite these cuts, the administration announced that it would be raising the wages of all non-union employees—professors, administrators, and athletic staff—by 2 percent, all of which were announced at a Nov. 8, faculty town hall meeting.

“I might end up regretting the decision that I have made to proceed with the increase,” said Morris during the gathering. “You heard this from me because I am not going to hide behind somebody else to deliver this kind of news.”

The deficit started reaching critical levels in the Fall 2023 semester when the administration discovered that SLU would lose a projected $4.296 million in student revenue for the 2023-24 academic year as a result of SLU’s student retention rate.

Since 2014, SLU has seen a 17 percent drop in enrollment — from 2,508 down to 2,089 students. Additionally, SLU’s cohort graduation rates have seen an 11 percent decline — with 80.5 percent of students who matriculated in the fall semester of 2010 graduating within 4 years, as opposed to the 69.1 percent of students who graduated that matriculated in the fall of 2019.

According to Morris, each student SLU loses costs $40,000 in revenue, which means that every 25 students SLU loses results in a million-dollar deficit increase.

Chair of Economics Brian Chezum pointed out during the meeting that these changes will put SLU employees in an uncompetitive position in the labor market. He says that the $1.4 million SLU will save from change to retirement contributions will substantially affect the young faculty members. “This will make a major setback in their ability to build wealth for retirement,” he said.

SLU administration made a similar decision during the COVID-19 pandemic in 2020 when the administration also reduced retirement contributions from 10 percent to 6 percent. Robert Blewitt, a former professor of economics at SLU, voiced his concerns regarding the reduction in an email addressed to SLU faculty and staff in July 2020. He demonstrated that due to the power of compound interest that these changes will disproportionally affect younger professors.

According to Blewitt, over a seven-year window, a full professor or staff member whose salary is fixed at $75,000 per year and who retires in 30 years would miss out on more than $280,000 while the university would save just $21,000. “The extra $1 SLU gets to spend means younger faculty/staff each missing out on $17.25 in retirement; this policy is not a big deal to me. Why? If I retire in four years, a $1 loss is not $17.25 at retirement but less than a buck fifty.” he said. “I ain’t crying. Some of you ought to be.”

During the November town hall meeting, Morris asked SLU employees to become more financially responsible and save for themselves. Yet, Blewitt emphasized in his message to his colleagues that younger faculty cannot afford to put money away, especially those with children. “Saving is extremely hard. There are always more immediate, pressing needs. Life happens. Children need braces. Cars need major repairs or replacement,” he said. “If you wait until the kids are grown, and the house is paid off, then you may have only seven or eight years left to retirement. It takes $8,600 to get the same impact of the $1,000 saved early.”

SLU’s situation is not unique, especially amongst other universities in St. Lawrence County. SUNY Potsdam was forced to cut 14 academic programs in September as its administrators face a $9 million deficit and a 43 percent loss in enrollment since 2010. Clarkson University is also planning to cut back program offerings — likely opting to downsize their humanities offerings and focus more on STEM programs.

In 2009, Blewitt warned his colleagues that allowing the university to cut retirement benefits could lead to more frequent cuts in the future. “If we tear down the wall protecting our long-term retirement benefits, it will be unlikely to ever be rebuilt again,” he said. “Do it for the first time, and we’ll find doing it a second time will be much easier.”